A Comprehensive Guide on How to Use a DSCR Loan

If you’re searching for DSCR loans near me or need flexible financing for rental properties, you’re in the right place. Debt Service Coverage Ratio (DSCR) loans are revolutionizing how investors and businesses secure funding no traditional collateral needed. This guide covers DSCR loan requirements, 2025 rate trends, and how to apply for the best DSCR loans in Florida and nationwide.

What Is a DSCR Loan?

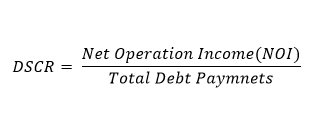

A DSCR loan evaluates your ability to repay debt based on cash flow, not just credit scores.

DSCR = net Operating Income (NOI) / Total Debt Payments

Key Formula:

- DSCR > 1.25: Most lenders require this to approve loans.

- DSCR = 1: Break-even (riskier for lenders).

👉 For first-time borrowers, explore our Closing Cost Calculator to estimate expenses.

DSCR Loan Requirements: 5 Steps to Qualify

- Calculate Your DSCR: Use rental income or business revenue.

- Gather Documents: Tax returns, bank statements, and lease agreements.

- Credit Score: Aim for 640+ (some lenders accept lower).

- Property Appraisal: Required for investment-focused loans.

- Reserves: 6 months of mortgage payments in savings.

Florida Tip: Coastal properties may need hurricane insurance for approval.

DSCR Loan Rates 2025: What to Expect

While 2024 rates hover around 7-9%, experts predict DSCR loan interest rates 2025 could dip to 6.5-8.5% as inflation stabilizes.

Compare Options:

- Short-Term Rentals: Rates often 0.5% higher due to volatility.

- Long-Term Rentals: Lower rates with stable tenant income.

👉 Need a conventional option? See DSCR Loans for lower rates with stricter criteria.

How to Use DSCR Loans for Investment Properties

1. Rental Properties

- Single-Family Homes: Use NOI from existing rentals to qualify.

- Multi-Unit Buildings: Scale your portfolio with higher loan amounts.

2. Short-Term Rentals (Airbnb/Vrbo)

- Pros: Higher income potential.

- Cons: Stricter DSCR requirements (often 1.5+).

3. Fix-and-Flip Projects

- Use a short-term DSCR loan (12-24 months) to fund renovations.

👉 For construction projects, explore DSCR Loans with flexible draw schedules.

Best DSCR Loan Lenders Near Me (2025 Update)

|

Lender |

Specialty |

2025 Rates |

|

InkMortgage |

Investment Properties |

6.75% - 8.25% |

|

Local Credit Unions |

Florida Rentals |

7.0% - 8.5% |

|

National Banks |

Multi-State Portfolios |

7.5% - 9.0% |

Tip: Ask lenders about DSCR Loans for rural investment properties.

How to Apply for a DSCR Loan: 3 Simple Steps

- Pre-Qualify: Submit basic financials to estimate loan size.

- Submit Formal Application: Include property details and income docs.

- Underwriting: Lender verifies DSCR and property value.

🚀 Start your DSCR Loan Application today with InkMortgage!

Risks & How to Avoid Them

- Rising Rates: Lock in fixed rates if you expect hikes.

- Vacancy Periods: Maintain a 6-month cash reserve.

- Balloon Payments: Refinance early with an DSCR Loan if needed.

FAQs

Q: Can I get a DSCR loan for a vacation rental?

A: Yes! Use projected rental income to qualify.

Q: Are DSCR loans better than conventional loans?

A: For investors, yes—they prioritize cash flow over personal income.

Q: How fast can I close?

A: As little as 14 days with InkMortgage.

Final Tips

- Compare Lenders: Check reviews and ask about prepayment penalties.

- Plan for 2025: Refinance if rates drop significantly.

- Go Local: Florida lenders understand hurricane-related risks.

Ready to grow your portfolio? Find DSCR Loan Lenders Near You and unlock your next investment!